What is Real Estate?

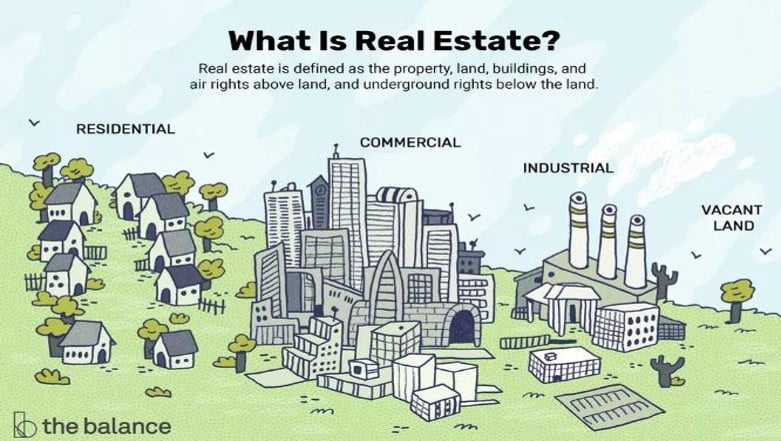

Real estate is all about property—land and the buildings on it. It can include homes, apartments, offices, shopping centers, and more. Real estate is everywhere you look, from your home to the store down the street. It’s a big part of our lives because it provides places to live, work, and play.

Types of Real Estate

There are several types of real estate. Understanding the differences can help you make better decisions whether you’re buying, selling, or investing.

Residential Real Estate: This is the most common type. It includes single-family homes, townhouses, condos, and apartments. People buy these properties to live in or rent them out to others.

Commercial Real Estate: These are properties used for business purposes. Examples include office buildings, retail stores, shopping malls, and hotels. Companies buy or rent commercial properties to run their operations.

Industrial Real Estate: This includes factories, warehouses, and distribution centers. These properties are used for manufacturing, storage, and transportation of goods.

Vacant Land: Land without buildings is also real estate. Some people buy land to build homes or businesses, while others hold onto it as an investment, hoping its value will increase over time.

Special Purpose Real Estate: These properties serve a specific purpose, like schools, churches, and government buildings. They’re not typically bought or sold as often as other types of real estate.

The Home Buying Process

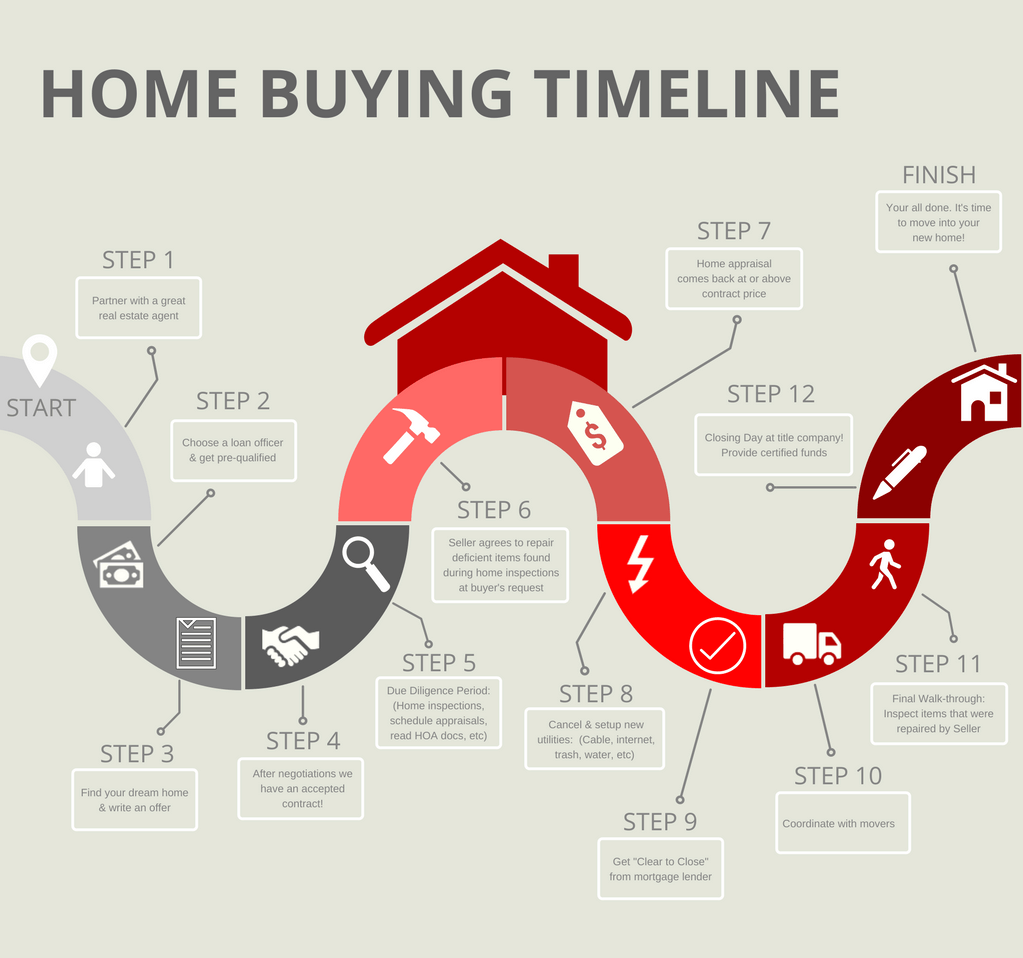

Buying a home is a big decision, and it involves several steps. Here’s a simple overview of what you can expect:

Getting Pre-Approved for a Loan: Before you start looking at homes, it’s a good idea to get pre-approved for a mortgage. This gives you an idea of how much you can afford and shows sellers that you’re a serious buyer. You’ll work with a loan officer who helps you find the right loan for your needs.

Finding a Real Estate Agent: A real estate agent is your guide through the home-buying process. They help you find homes that fit your budget and preferences. They also negotiate on your behalf and help you with paperwork.

Searching for Homes: With your agent, you’ll start looking at homes. This is the fun part! You’ll visit different properties and figure out what you like and don’t like.

Making an Offer: Once you find a home you love, your agent will help you make an offer. This is a formal statement of how much you’re willing to pay. The seller can accept, reject, or counter your offer.

Home Inspection: After your offer is accepted, it’s time for a home inspector to check out the property. They look for any problems with the home, like issues with the roof, plumbing, or electrical systems. If they find something, you might negotiate repairs or a lower price.

Appraisal: Your lender will require an appraiser to determine the home’s value. This ensures that the loan amount is in line with the home’s worth.

Title Search and Title Insurance: The title company checks to make sure the property’s title is clear of any legal issues, like unpaid taxes or claims from other people. They also provide title insurance to protect you and the lender from any future problems with the title.

Final Walkthrough: Before closing, you’ll do a final walkthrough of the home to make sure everything is in order.

Closing: This is the final step! You’ll sign a bunch of paperwork, pay your down payment, and get the keys to your new home.

The Home Selling Process

Selling a home involves many of the same steps as buying, but from the opposite side. Here’s what it looks like:

Choosing a Real Estate Agent: Just like in buying, you’ll want a real estate agent to help you sell your home. They’ll help you price it right, market it, and negotiate with buyers.

Setting the Price: Your agent will help you determine the right price for your home. They’ll look at similar homes in your area that have recently sold to help set a competitive price.

Marketing Your Home: Your agent will take photos, create listings, and promote your home online and in print. They might also host open houses or showings.

Negotiating Offers: When a buyer makes an offer, you can accept it, reject it, or make a counteroffer. Your agent will help you navigate this process and negotiate the best deal.

Home Inspection: After accepting an offer, the buyer will usually hire a home inspector to check out your property. If issues are found, you might need to make repairs or negotiate a lower price.

Appraisal: The buyer’s lender will require an appraiser to determine the value of your home. If the appraisal comes in lower than the offer, you may need to renegotiate the price.

Title Search and Title Insurance: The title company will ensure that the title is clear and that there are no legal issues with the property.

Closing: On closing day, you’ll sign the final documents, transfer the title to the buyer, and receive the payment for your home.

Major Parties in a Real Estate Transaction

Many parties are involved in a real estate transaction. Here’s a breakdown of who they are and what they do:

Real Estate Agent: Whether you’re buying or selling, a real estate agent is your guide through the process. They help you find homes, make offers, negotiate, and handle paperwork.

Loan Officer: This person works for a bank or mortgage company, your main point of contact for your lender. They help you get a loan to buy a home. They’ll review your finances, help you choose the right mortgage, and guide you through the approval process.

- Underwriter: The underwriter works for the loan officer and decides whether to approve your loan. They evaluate your credit, income, and the property’s value to make sure you can repay the loan.

Title Company: The title company makes sure that the property’s title is clear and handles the transfer of ownership. They also provide title insurance, which protects against any legal issues that might come up later. An owner’s title policy is usually paid for by the seller, while a lender’s policy is usually paid for by the buyer.

Home Inspector: The home inspector’s job is to check the property for any issues. They look at the roof, foundation, plumbing, electrical systems, and more. Their report helps you understand the condition of the home and if any repairs are needed.

Appraiser: The appraiser assesses the home’s value. This ensures that the price you’re paying (or receiving) is fair. Lenders require an appraisal before approving a loan.

Surveyor: A surveyor measures the property’s boundaries and identifies any issues with the land. This is important for determining exactly what land is included in the sale.

Builder: If you’re buying a new home, the builder is the company or person who constructs the house. They work with architects and contractors to bring the home to life.

Local Government: Local government agencies are involved in approving permits and ensuring the property complies with building codes and zoning laws. They also assess property taxes.

Homeowners Association (HOA): If the property is in a community with a homeowners association, the HOA manages the common areas and enforces rules. They’ll provide information on dues and any restrictions that might affect your purchase.

Conclusion

Real estate can seem complex, but it’s really about finding the right property and going through the necessary steps to make it yours. Whether you’re buying or selling, having the right people on your team—like a real estate agent, loan officer, and title company—makes the process smoother. Understanding the basics of real estate types and the steps involved helps you make informed decisions and feel confident as you move through the process.